The right car insurance coverage is waiting for you

Explore the types of coverage Root offers to protect you and your car.

Car insurance coverage types

We make car insurance simple by explaining what coverages are required in your state and which are optional. Learn about the coverage types we offer, then customize your policy in the Root app any time.

Bodily Injury Liability Coverage

Required by law in most states.

Bodily Injury Liability Coverage covers injuries to others when you cause an accident. Learn more about choosing Bodily Injury Liability Coverage.

Why is this important?

Bodily Injury Liability Coverage will pay for medical, funeral expenses, and lost wages for other people when you cause an accident.

Important details:

It's the law. Nearly every state requires drivers to have Bodily Injury Liability Coverage.

It typically doesn't cover you or your family members (that's what Medical Payments, Personal Injury Protection, and UM/UIM coverages are for).

Property Damage

Required by law in all states

Property Damage covers damage to other vehicles or property when you cause an accident. Learn more about choosing property damage coverage.

Why is this important?

If you cause an accident that damages another vehicle or any other property, Property Damage will cover those costs.

Important details:

It's the law. Everyone is required to have Property Damage insurance.

It does not cover your vehicle (that's where Collision and Comprehensive coverages come in).

Roadside Assistance

Roadside Assistance covers the services you need when you are stranded on the side of the road by the unexpected.

Why is this important?

Whether you need a tow or an emergency fill-up, we've got the help you need to get back on the road.

Important details:

You can opt to include Roadside Assistance with every policy.

If you need Roadside Assistance, make a request through the app. Our Roadside Assistance partner is ready to help.

For vehicles on your policy, you’re covered for three incidents per vehicle, per 6-month policy term, up to $100 per incident.

Looking for more protection? Learn about mechanical breakdown insurance here.

Collision

Collision pays for covered damage to your vehicle when you cause an accident. Learn more about Collision coverage and how to go about choosing the right Collision coverage.

Why is this important?

If you cause an accident, Collision coverage will pay for repairs to your car or for a replacement vehicle of similar fair market valuewhen needed. Without it, you're paying out of pocket.

Important details:

This also covers damage to your vehicle if you are hit by someone without insurance or are involved in a hit-and-run.

Coverage costs vary based on your vehicle. Have a newer or more expensive car? Expect Collision to cost more. You can find the cost easily in the app.

Financing or leasing your vehicle? Your lien holder (leasing company) may require you to have Collision.

Remember, claims always work on a case-by-case basis.

Comprehensive

Comprehensive insurance pays for covered damage to your vehicle caused by anything other than an accident. Learn more about choosing Comprehensive coverage.

Why is this important?

If your car is damaged by a storm or if it's stolen, Comprehensive coverage will pay for repairs or for a replacement vehicle of similar fair market value. Without it, you may be paying out of pocket.

Important details:

This pays for covered damage such as hail or other storm damage, flood damage, car theft, a broken windshield, or damage from wildlife.

Coverage costs vary based on your vehicle. Have a newer or more expensive car? Expect Comprehensive to cost more. Find out the cost right in the app.

Financing or leasing your vehicle? Your lien holder (leasing company) may require you to have Comprehensive.

There are limitations to the coverage, including intentionally damaging the vehicle.

Rental

When your vehicle is being repaired and you need a ride, Rental car coverage has you covered. Learn more about choosing Rental coverage.

Why is this important?

If you were in an accident and your car is being repaired, you may need a rental vehicle to get around. With Rental coverage, you have one less thing to worry about.

Important details:

We offer you options—car rental or rideshare/taxi reimbursement.

We'll help you choose which option is best for you depending on your claim.

Uninsured Motorist Property Damage

Required by law in 8 states

Uninsured Motorist Property Damage (UMPD) covers your property when it is damaged by an uninsured driver. Learn more about choosing UMPD coverage.

Why is this important?

Accidents happen, but if you’re hit by someone without insurance, you could get stuck paying for damage caused to your property. With UMPD, your property is covered regardless of whether the at-fault driver can pay. That’s good news for you.

Important details to consider:

UMPD also covers damage caused from a hit-and-run.

Collision and UMPD both cover damages caused by uninsured drivers. If you have Collision coverage, you typically do not need UMPD, although UMPD may have a lower (or no) deductible.

We currently only offer UMPD in certain states.

Personal Injury Protection

Required by law in 17 states

Personal Injury Protection covers medical expenses and lost wages for you and your family members, no matter who causes the accident. Learn more about choosing Personal Injury Protection coverage.

Why is this important?

If you're in an accident, Personal Injury Protection covers medical expenses and lost wages for you and your family members. Your state may require this coverage.

Important details:

Some states offer Medical Payments, others offer Personal Injury Protection. A few offer both.

All no-fault states require you to have Personal Injury Protection coverage.

Not sure if you need Personal Injury Protection or Medical Payments? Don't worry. Our app makes sure you have the required coverage for your state.

Medical Payments

Required by law in 8 states

Medical Payments coverage helps pay for injuries to you or your family members, no matter who causes the accident. Learn more about choosing MedPay coverage.

Why is this important?

If you're hurt in an accident, MedPay covers medical expenses for you or your family members. Without it, you may be paying out of pocket, and that can really add up (think ambulance rides, surgery, hospital stays, etc). Your state will offer either Medical Payments or Personal Injury Protection.

Important details:

This coverage follows the policyholder and applies both in and out of state. That means if you're hurt in an accident using public transportation, riding a bike, or in a friend's car, you're covered.

If you don’t have health insurance, and are in a car accident, coverage could be helpful.

Some states offer Medical Payments, others offer Personal Injury Protection. A few offer both. Our app makes sure you get the right coverage for your state.

Uninsured and Underinsured Motorist Bodily Injury

Uninsured/Underinsured Motorist Bodily Injury (UM/UIM) covers your medical expenses when you are injured by an uninsured or underinsured driver. Learn more about choosing UM/UIM coverage.

Why is this important?

Unfortunately, not everyone on the road has liability insurance or enough insurance to cover your medical expenses if they cause an accident. If that happens, UM/UIM kicks in and you're covered. Otherwise, you may be stuck with expensive medical bills.

Important details:

You may see this coverage referred to as UM/UIM.

Some states require that UM and UIM coverages be sold separately.

Not sure if you need them separately? Don't worry. Our app makes sure you have the right coverage for your state.

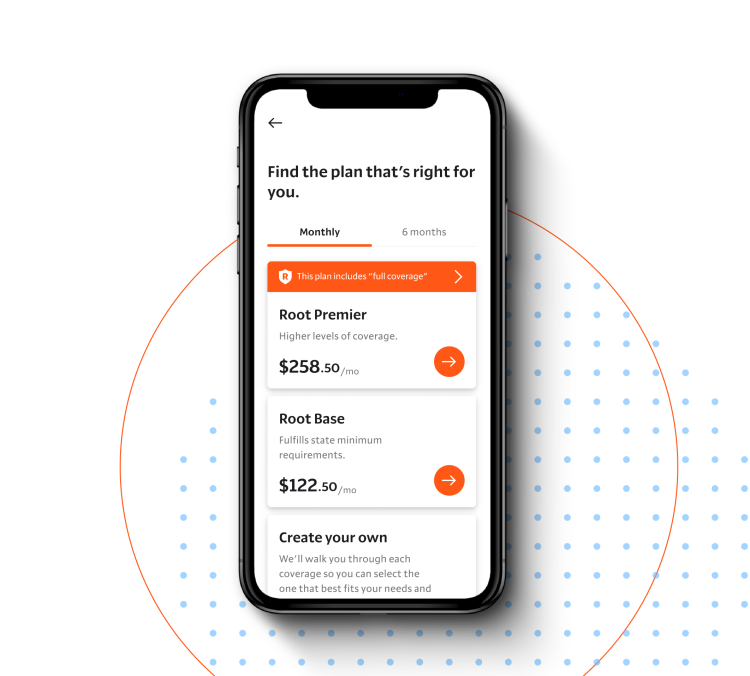

Looking for full coverage insurance?

There’s actually no such thing as “full coverage” in the industry, but the term usually refers to combining Liability (Bodily Injury and Property Damage), Collision, and Comprehensive. Root offers all of these coverages.

A few words from happy customers

Root is absolutely amazing. This cut my insurance down by over $140 a month. I'm so happy to be confident in high quality insurance at an affordable price. Also customer service has responded quickly and efficiently to every issue and question.

Benjamin C.

It dropped my insurance rate from $1200 through Allstate for 6 months down to a little over $600. That’s amazing! Especially with me having MORE coverage than before. It’s amazing what this company is doing and their app is great, too.

Kyle M.

Decided to give the test drive a shot, and after about 3 weeks got my quote and I had to do a double-take. My wife and I previously had separate policies, but the price through Root was cheaper for both of us than just myself alone. Not only that, but it includes more coverage and a lower deductible.

Eric C.