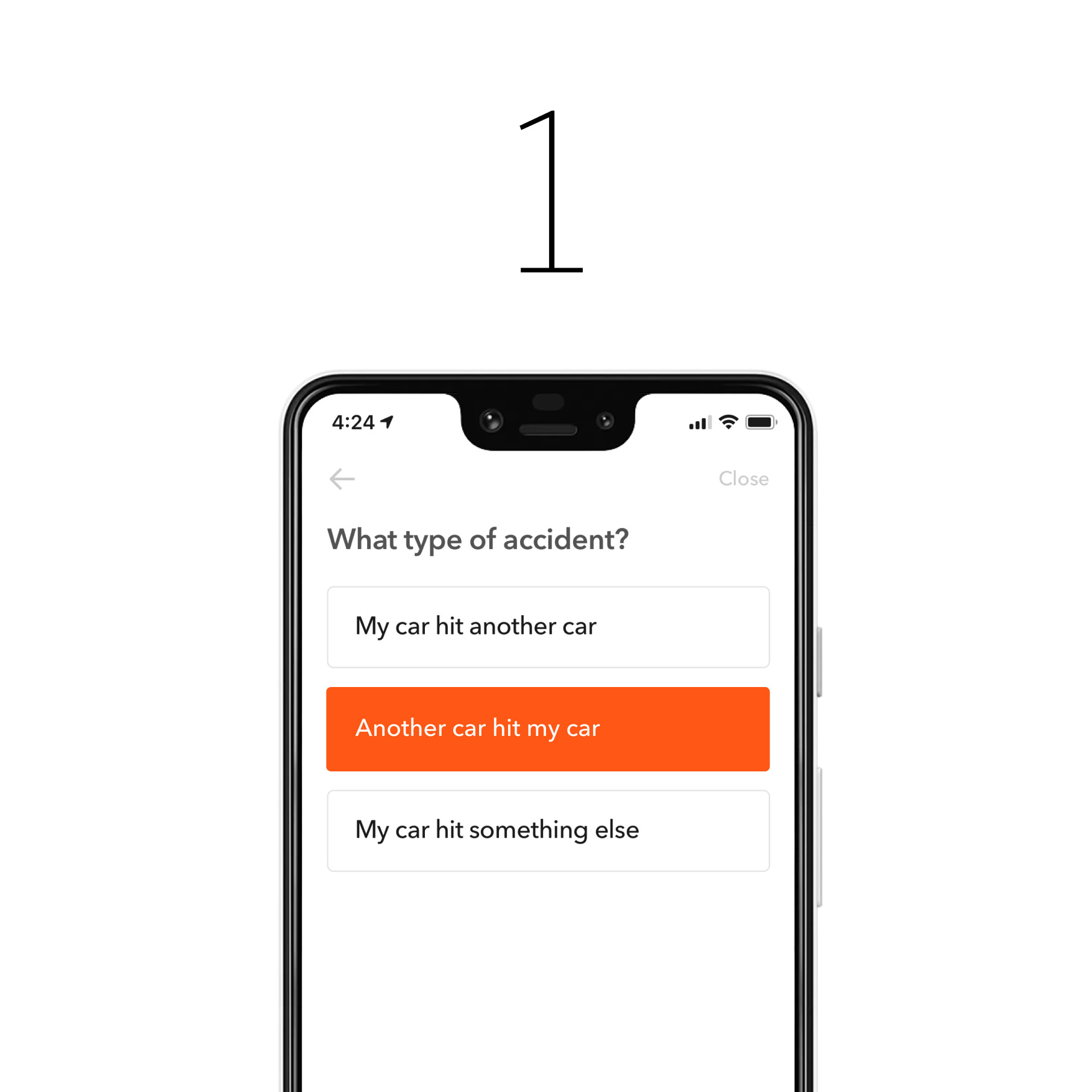

How do I file a claim?

Go to the app

Answer a few questions about the accident.

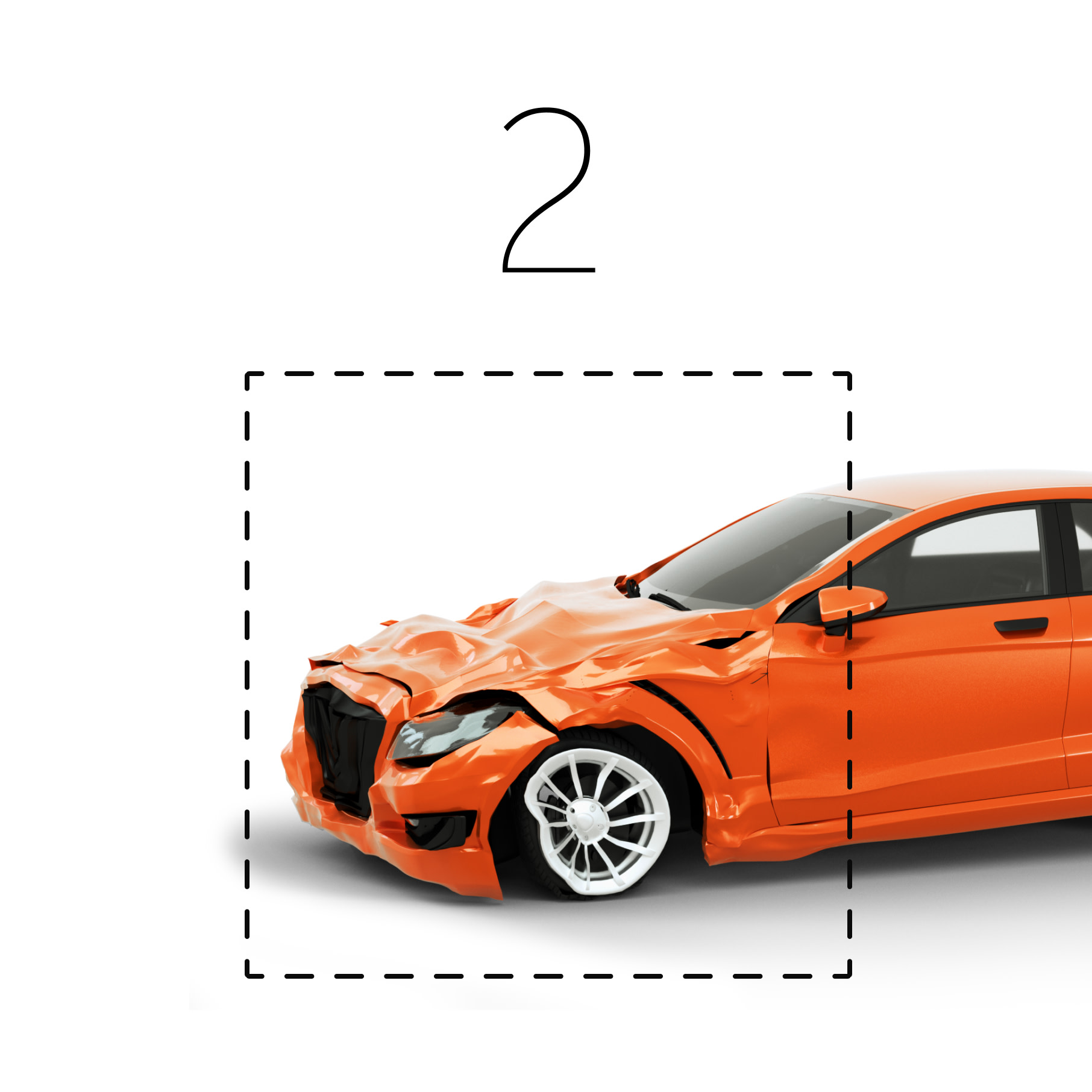

Take pictures

Get as many angles as you can of your vehicle to show the damage.

Then it’s our turn

We’ll reach out to complete your claim.

We’ll stay in touch

We email you at every step of the insurance claim process. You can also use the app at any time to see status updates.

Get your ride back in shape

Pick your favorite shop to repair your vehicle. Or, you can search the Automotive Service Excellence site for reputable shops near you.

Claim process was smooth and required minimal effort on my part.

Jason M.

I received a call and text from my incredibly attentive and professional adjuster. She handled it all, very timely.

Susan B.

They have been in constant contact with me every day! They make filing a claim really simple and fast.

Chenise W.